Investing in Your Retirement

Why Should I Invest in My Retirement?

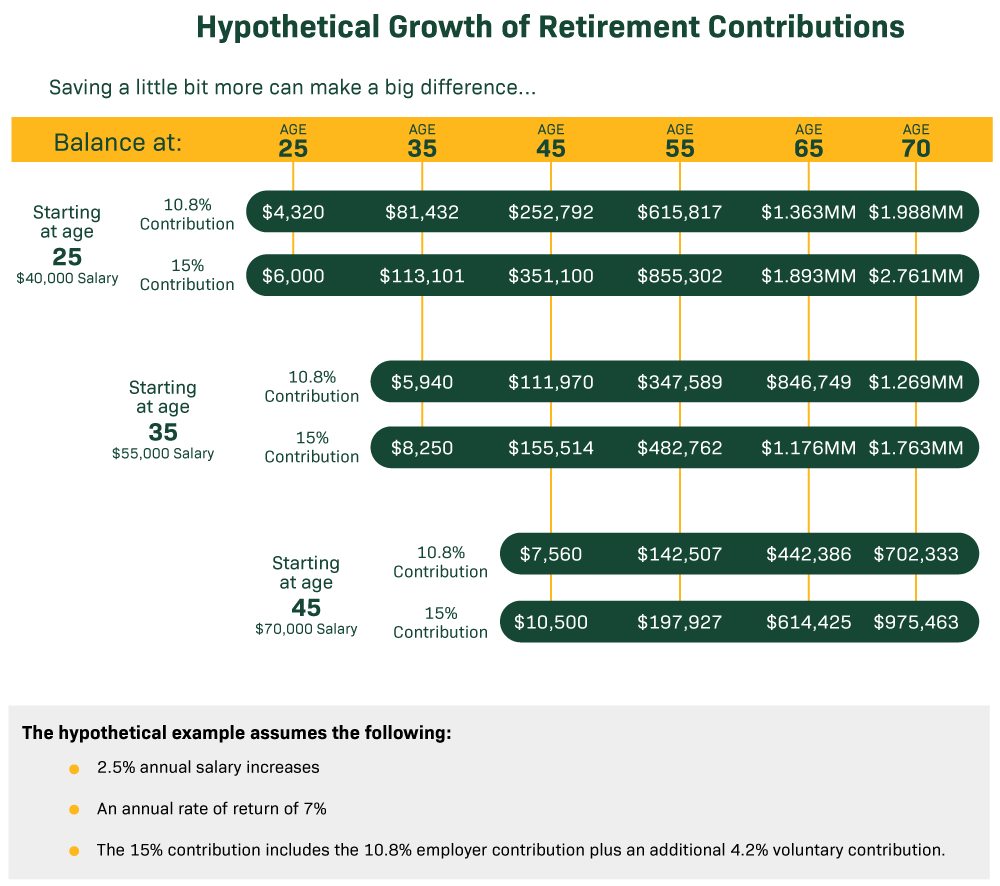

Contributing towards our own retirement is something each of us should take ownership in. Baylor is very generous in supporting its employees in their efforts to contribute towards and prepare for their future retirement, however, relying on Baylor's contribution alone may not be enough to effectively prepare someone for retirement and the lifestyle they wish to have during their retirement years. We encourage everyone to contribute towards their retirement and speak to a CAPTRUST advisor to help determine what you should be contributing and create a plan to help you reach your retirement goals.

Pre-Tax Vs. Roth Contributions Info: If you'd like to learn more about Pre-Tax vs. Roth contributions, then watch this Understanding The Roth Plan Option Presentation provided by CAPTRUST.

Schedule an appointment with CAPTRUST: Scheduling an appointment with CAPTRUST gives you access to receive free, unbiased financial advice regarding your Baylor Retirement Plan investment choices.

Schedule a CAPTRUST Appointment

CAPTRUST Retirement Tools & Calculators

Are you on track? Schedule an appointment with a TIAA Financial Consultant.

TIAA is here to help! TIAA financial consultants are dedicated to helping you with your retirement goals. TIAA offers personalized advice and education to Baylor participants, at no additional cost. Take time now to get advice that can help you plan for the long term. TIAA financial consultants can help you answer these questions:

- Am I saving enough?

- Do I have the right mix of investments?

- What is my plan for my financial goals including retirement?

If you're ready to make an appointment today, TIAA currently has sessions available for Baylor faculty and staff. Schedule an appointment or see our available dates and times using the button below.

TIAA Consultations & Seminars webpage

Importance of Retirement Planning

Thasunda Brown Duckett is CEO of TIAA, a leading provider of secure retirements and outcome-focused investment solutions to millions of people working in higher education, health care and other mission-driven organizations, such as Baylor University. Mrs. Duckett joined Baylor’s 2022 Spring all-staff meeting to discuss the importance of retirement planning.

Video: Retirement Planning with Thasunda Brown Duckett

How do I save for retirement?

There are 2 ways to save for retirement at Baylor. Learn more about each plan by visiting the websites below.

How do I start/update my account?

If you are ready to enroll or need to change your contribution, please follow the instructions below.

- 1. Establish OR Login to your account with TIAA at www.tiaa.org/baylor.

- Click READY TO ENROLL if first-time OR LOGIN for returning

- For employee contributions, select the employee contribution (RCP) account.

- For Baylor employer contributions, select the employer contribution (RC) account.

- Make your investment elections and beneficiary designations. Please note, if you are establishing both employee and employer accounts you will need to make investment elections and beneficiary designations for both accounts.

- Contact TIAA at 800.842.2252 if you need assistance with establishing your retirement accounts.

- 2. Establish OR Update your personal retirement contribution elections.

- Effective February 20, 2023, you will make any personal retirement plan contributions directly within your TIAA retirement account. Please go to tiaa.org/baylor to login to your account to make your contribution elections.

- For the Baylor discretionary contribution, if you satisfy the age requirement, but have not satisfied the service requirement, then you will need to complete the form below to receive partial credit towards the one year of service requirement.

Prior University Work Experience Form

Please Note: If you fail to establish your TIAA retirement account(s) prior to the funding of your first contribution, accounts will be established on your behalf and your funds will be placed in the plan default investment option which is the age appropriate Vanguard Target Retirement Fund. At that time, you can make changes to your investment elections and establish your beneficiary designations.

What if I need to make a withdrawal?

You should contact TIAA to initiate any withdrawals from your retirement account. Please refer to the BRP Summary of Plan Provisions for information on the types of withdrawals that are allowed to be made from your Baylor retirement account.

You can begin the process of requesting a withdrawal by logging into your TIAA Account or by calling 800.842.2252.

Who can help me with retirement questions?

Please reach out to the following resources to help answer any questions you may have about the Baylor Retirement Plan or your retirement account.